Article by: Rosebank Accountant: Vincent Motsi

Only the most optimistic among us would declare Budget 2024 a Small Business friendly budget!

The budget deficit is estimated to worsen from 4% to 4.9% of GDB this financial year, which means that debt service costs increase by R15.7 billion bringing the estimated total for the 2024 years to R356 billion.

So, what are the positives?

The negatives?

Government has made no effort to support small business of the individual taxpayer with this budget, the clear facts are that business ownership for all entrepreneurs is going to carry more “penalties” and encounter more red tape than many might think the risks warrant!

So how can these penalties be mitigated? Once again, the best way is to ensure your business qualifies as a small business corporation (SBC) as this still allows for a little breathing room from the new tax increases.

How, may you ask?

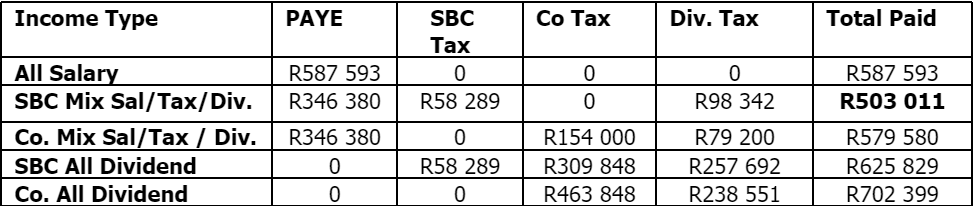

The table below illustrates the different outcomes on R1 656 601 million profit and shows that being an SBC is still clearly the best option.

At SME.TAX we do more than just assist clients with tax planning, we are your “one-stop SME shop”, assisting with everything from Accounting, Business Management, BEE, Consulting, Company Registration to Payroll and Mentoring

For more information, please visit our website www.sme.tax or give us a call on 012 021 0829