Article by: Midrand Accountant: Mollen Mkuze

What is ETI

The Employment Tax Incentive (ETI) is a vital component of South Africa’s strategy to promote employment, especially among young and low-income workers. This incentive is designed to reduce the cost of hiring for employers, thereby encouraging businesses to create more jobs. Within Special Economic Zones (SEZs), the ETI offers significant benefits that can enhance the attractiveness of these zones for business operations. The ETI was implemented with effect from 1 January 2014.

Key Objective of ETI

The primary goal of the ETI is to combat high unemployment rates, particularly among the youth, by making it financially advantageous for businesses to hire young workers. The ETI provides a direct reduction in the amount of Pay-As-You-Earn (PAYE) tax that employers are required to pay to the South African Revenue Service (SARS).

How ETI Works

Employers who qualify for the ETI can reduce their PAYE liability by the amount of the incentive. Here’s a detailed look at how the ETI functions:

Eligibility Criteria for Employers

To be eligible for the ETI, an employer must meet the following criteria:

Eligibility Criteria for Employees

Employees must meet specific criteria for their employer to claim the ETI:

Calculation of ETI

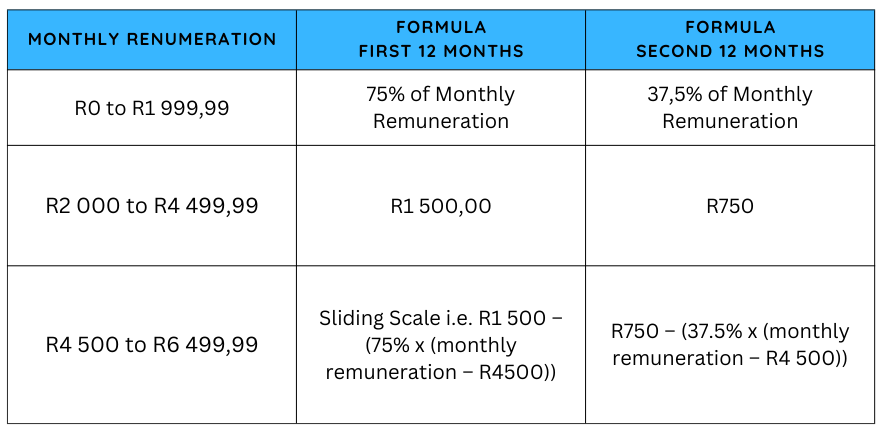

The ETI amount that an employer can claim depends on the employee’s monthly salary and the duration of employment.

The ETI Calculation Formulae that are Effective from 1 March 2022:

Benefits of ETI for Employers

For example, employers who are registered for PAYE, and who employ a person for the full month of February 2024 and earns R2000, will get R1 000 off their monthly PAYE liability (provided that the employee is a qualifying employee based on all the other remaining requirements).

How to Claim ETI

Employers can claim the ETI by following these steps:

Payroll System: Ensure that the payroll system is configured to calculate the ETI for eligible employees. Its very important to ensure that employee information is setup correctly.

Monthly EMP201 Declaration: Include the ETI amount in the monthly EMP201 declaration submitted to SARS.

Record Keeping: Maintain accurate records of all employees for whom the ETI is claimed, including their identity numbers, employment dates, and salary details.

Reconciliation: During the annual reconciliation process, ensure that all ETI claims are correctly reflected in the EMP501 submission to SARS.

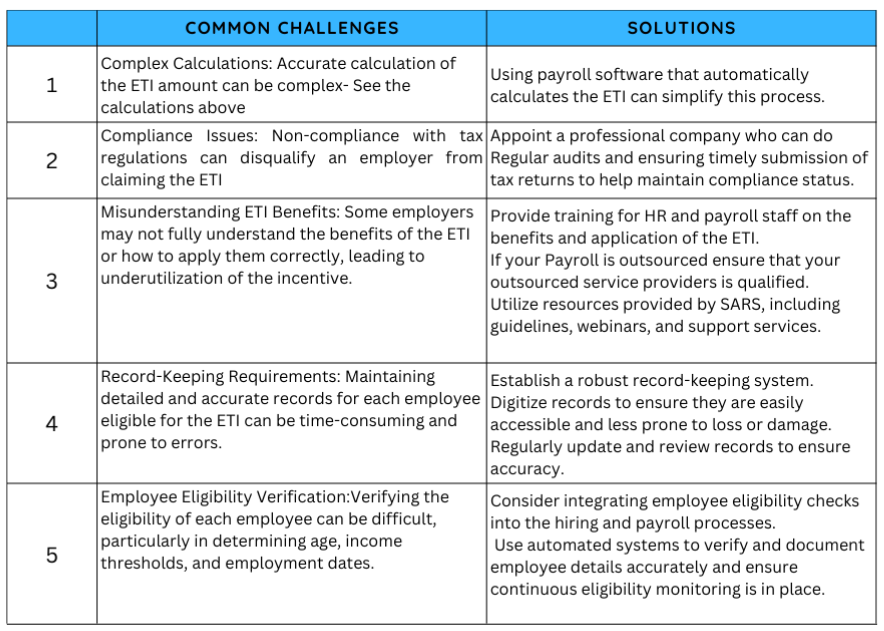

Common Challenges and Solutions

By addressing these common challenges with proactive solutions, businesses can effectively leverage the ETI to reduce hiring costs, support economic growth, and contribute to job creation in South Africa.

Conclusion

The Employment Tax Incentive is a powerful tool for businesses looking to reduce their tax burden while contributing to national employment goals. For businesses operating within SEZs, the benefits are even greater, providing an added incentive to establish operations in these zones. By understanding and effectively utilizing the ETI, businesses can not only improve their financial performance but also play a significant role in addressing South Africa’s unemployment challenges.

For more information, please visit our website: www.brendmo.com or give us a call on 011 026 3052