Article by: Midstream Accountant: Maritza Eybers

Employment Tax Incentive (ETI), what is it?

It is an incentive aimed at encouraging employers to hire young and less experienced work seekers. It reduces an employer’s cost of hiring young people through a cost-sharing mechanism with the government while leaving the wage the employee receives unaffected.

This incentive came into effect on 1 January 2014.

Who qualifies for the ETI?

Employers who are registered for Employees’ Tax (PAYE) with SARS.

Only employers who are tax compliant will be able to claim the ETI. However, the amount will be available, subject to limitations, once non-compliant employers become compliant.

Who doesn’t qualify for ETI?

National, provincial and local spheres of government

Employers who have been disqualified by the Minister of Finance due to displacement of employees or by not meeting conditions as may be prescribed by the Minister by regulation

When can the incentive be claimed?

Employers are able to claim the incentive when they have employees who:

Note: It can be claimed for a maximum of 24 monthly periods per qualifying employee.

How is the ETI claimed?

An employer can claim the incentive by decreasing the amount of PAYE that is payable to the SARS for every qualifying employee that is hired by the employer.

This is done by completing the Employment Tax Incentive (ETI) field on the employer’s monthly EMP201 submission to SARS.

Note: No refunds are currently permitted, and employers should be able to produce IDs for the employees that the incentive is claimed for, if required.

How does it work?

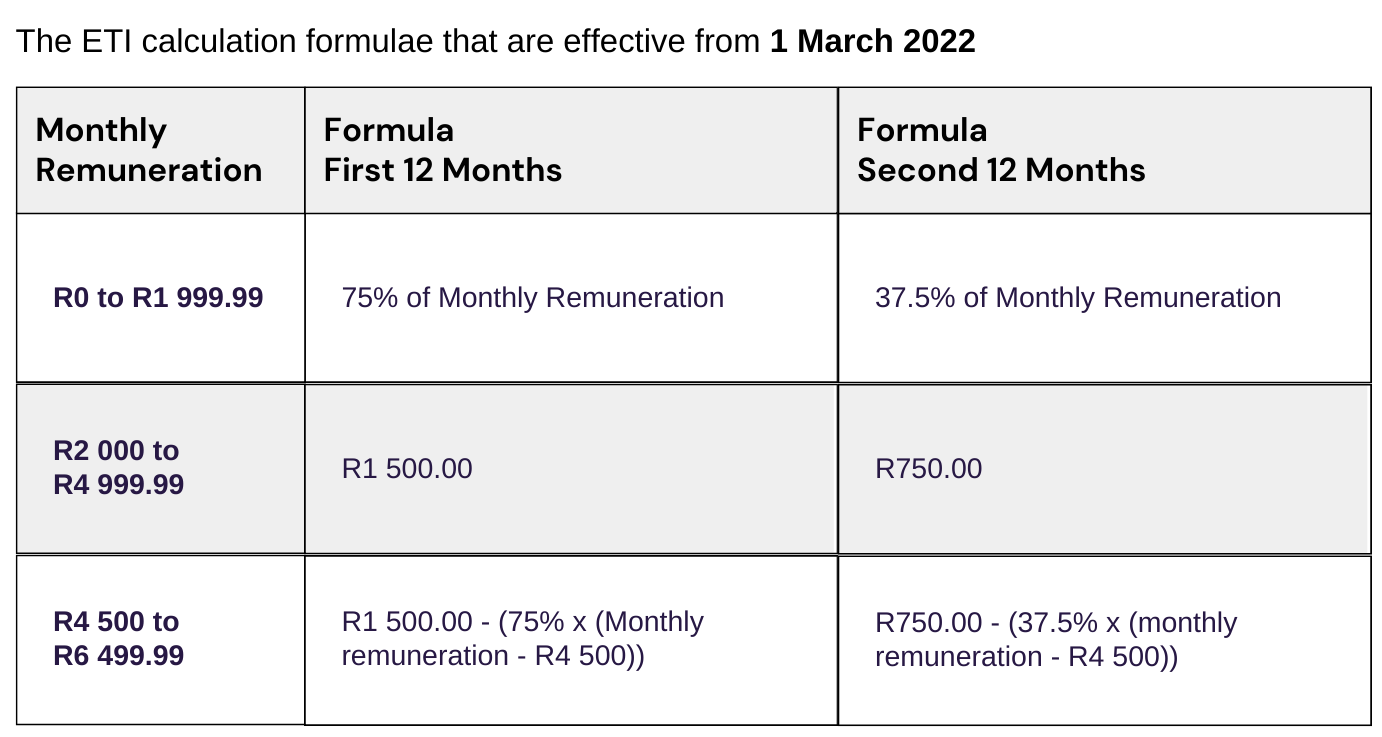

In determining the value of the incentive for a particular month, an employer must follow 5 steps:

At SME.TAX we do more than just assist clients with SARS, we are your “one-stop SME shop”, assisting with everything from Accounting, Business, Management, BEE, Consulting, Company Registration to Payroll and Mentoring.

For more information, please visit our website or give us a call on 012 0210829