Article by listed accountant TYRONNE NEL

Tax invoices: boy, is there a lot of confusion regarding these little beauties! Everybody, it would seem, has their own idea of what a Tax invoice is and information a Tax Invoice should contain and unfortunately the majority of them are wrong! Business Taxpayers must be aware that mistakes can sometimes result in penalties.

Put very simply, an invoice is a document issued by a business that is not a vendor for VAT and a Tax Invoice is a document issed by a business that is a vendor for VAT.

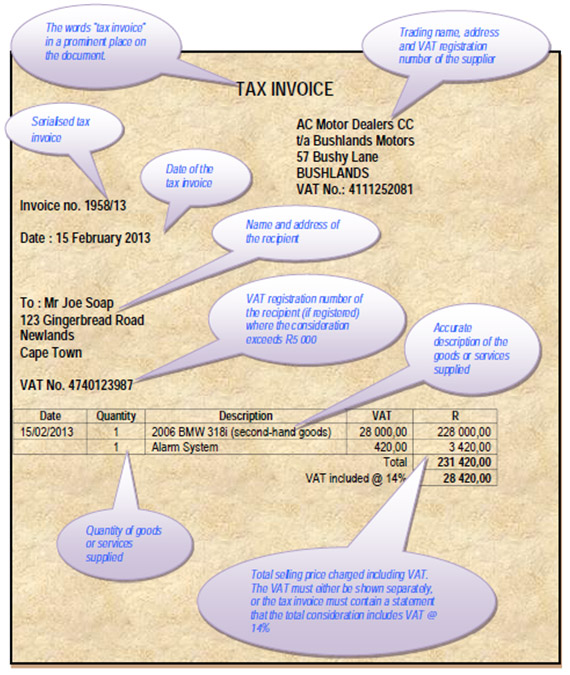

Where the value of the invoice is below R5000.00 you may use an abridged Tax invoice, which is less formal and only contains limited information. We however always recommend that you use the Full Tax invoice (see sample below with requirements highlighted) as it is a good habit to get as much information on your client as possible when invoicing.